State Street Investment Management has added two new ETFs to its enhanced active range, for investors seeking dynamic, actively managed equity solutions to navigate today’s shifting markets. These ETFs aim to provide actively managed equity exposure with controlled risk.

We have also launched our first fundamental active ETF, a Global Dividend Spotlight strategy to complement our existing Dividend Aristocrats range.

The new ETFs are:

State Street All World Enhanced Active Equity UCITS ETF

State Street World Small Cap Enhanced Active Equity UCITS ETF

State Street Global Dividend Spotlight UCITS ETF

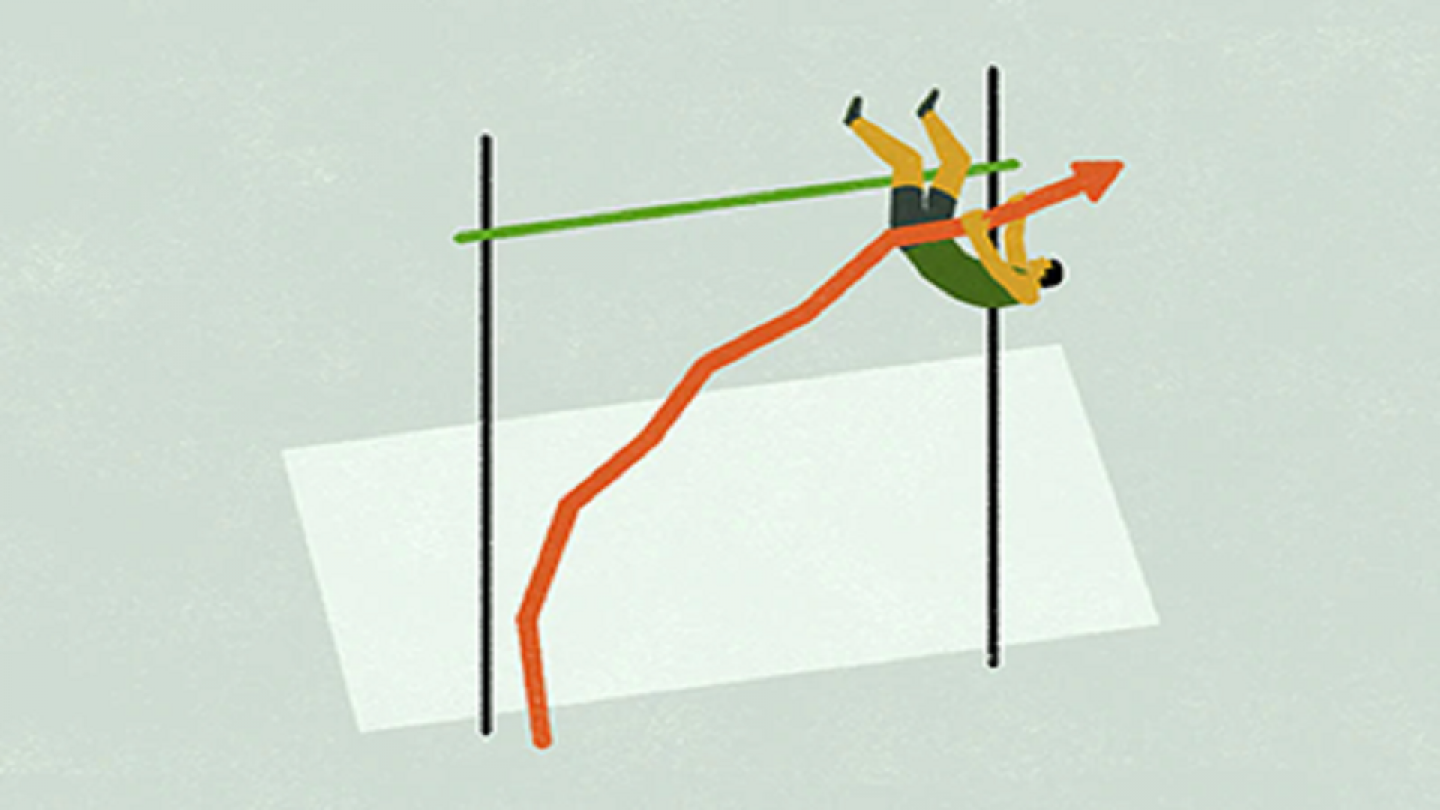

An enhanced active approach preserves the foundational benefits of passive investing while leveraging the strengths of systematic active methods.

Why choose State Street’s active Systematic Equity strategies?

• Performance: 100% / 100% / 97% of our benchmark-aware strategies have outperformed their respective benchmarks over three-, five- and ten-years.

• Scale: $36B USD Assets Under Management (AUM), spanning global, regional, large and small cap strategies.

• Heritage: State Street’s enhanced strategies are one of the longest serving capabilities, dating back to 1993, using over 80 proprietary alpha signals.