A market segment with unique characteristics, short-term High-Yield bonds offer particularly attractive intrinsic qualities that can complement an allocation. Emmanuel Petit invites us to explore this asset class and explains how the R-co Conviction High Yield SD Euro fund stands out in this universe thanks to its innovative approach.

Why focus on the short-term high-yield segment in euros?

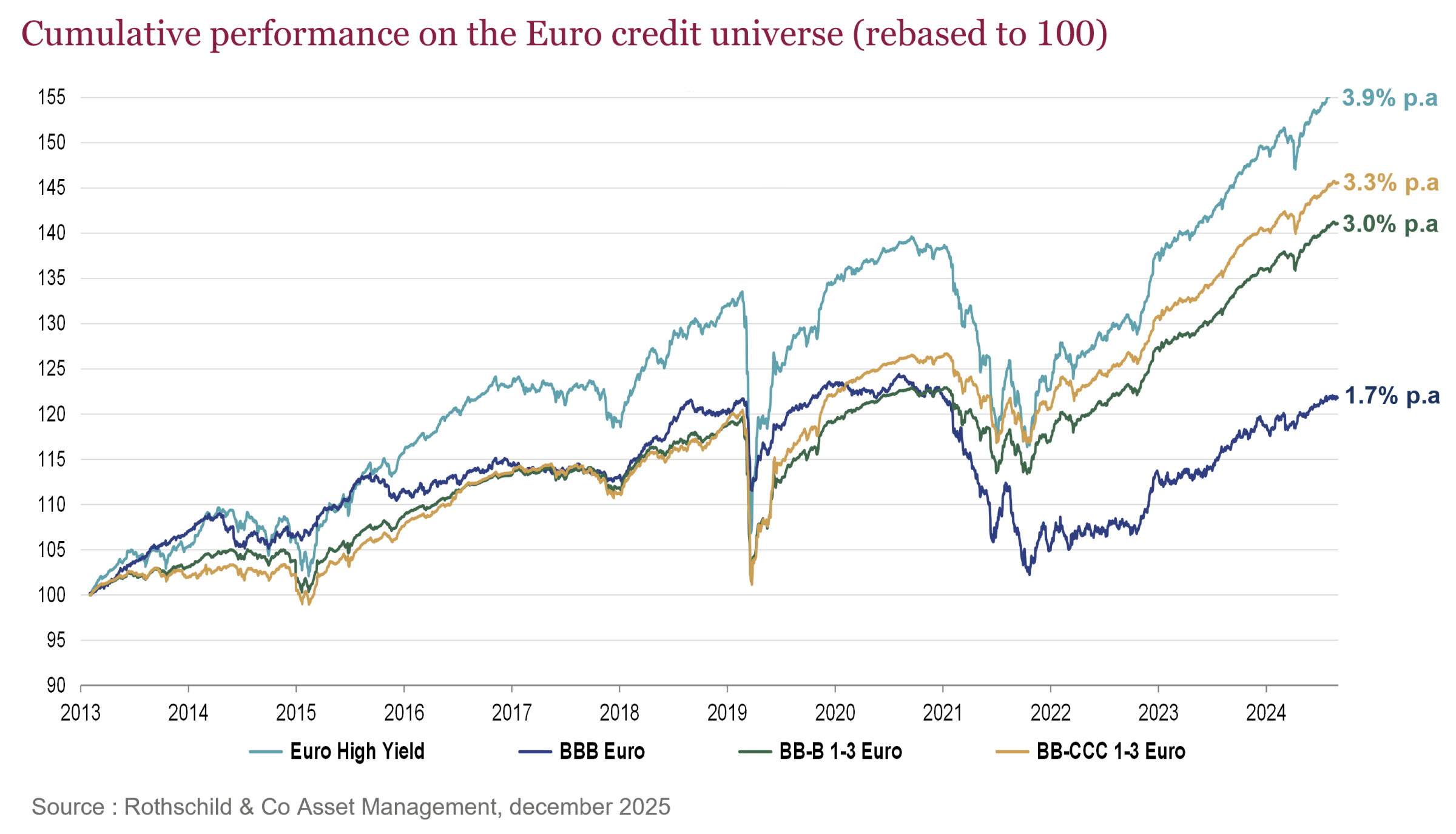

Emmanuel Petit: The 1-3 year high-yield (1) segment in euros currently offers a particularly attractive profile for investors seeking returns while controlling volatility. Over the long term, this segment has delivered an annualized return of 3.15%, with volatility of 2.7% (2), one of the best Sharpe ratios (3) in the European credit universe. This means that market risk is better rewarded at this short end of the curve, and that drawdowns (4) are historically more limited than in other credit segments.

What specific features of the current environment make this segment particularly attractive?

E.P: Given that the Sharpe ratio for 1-3 year high yield bonds denominated in euros is one of the best in the European credit universe, this makes it an attractive asset class in all circumstances. In the current environment, marked by lower risk premiums and a highly selective market, this characteristic becomes even more valuable. Even when spreads tighten, the short end of the curve continues to offer effective risk compensation, with controlled volatility.

How is the R-co Conviction High Yield SD Euro fund positioned to take advantage of this environment?

E.P: Our management philosophy is based on building an agile and flexible portfolio that can adapt to different phases of the credit cycle. We combine a rigorous carry approach, precise calibration of our convictions, and strict risk management. We prioritize the quality of exposure, with extensive diversification and allocation that evolves according to risk premium levels. What sets us apart is our ability to innovate: we use credit derivatives (5), particularly tranches on iTraxx CDS indices, to substitute the default risk of the most fragile issuers with market risk. This approach optimizes the risk/return ratio and strengthens the portfolio's resilience.

What are the fund's main differentiating strengths?

E.P: Our management team has over 20 years of expertise in the high-yield market, with complementary profiles and strong synergies with other divisions of Rothschild & Co Asset Management. Our tactical management aims to optimize the balance between defensive bias and risk-taking, and to deliver robust performance over the long term, while controlling volatility and risks specific to the short-term high-yield segment.

A final word for investors?

E.P: High yield 1-3 years in euros offers an attractive return with controlled market risk. Its volatility remains contained and, in the event of a correction, the return to better fortunes is generally rapid. Our R-co Conviction High Yield SD Euro fund stands out in particular for a relevant innovation: we do not take binary risks and we reduce exposure to credit risk. This makes it an attractive allocation component, regardless of market conditions, and especially when valuations are high.

(1) High-yield bonds are issued by companies or governments with high credit risk. Their credit rating is below BBB- on Standard & Poor's scale.

(2) Source: Rothschild & Co Asset Management, December 2025.

(3) Measure of the performance gap between a portfolio of financial assets and the rate of return on a risk-free investment, divided by the standard deviation of its profitability as defined by its volatility.

(4) Decline in the value of an investment or fund.

(5) Financial instrument that allows investors to gain exposure to the credit market without having to directly own the underlying asset.