Why adding thematic equities to a portfolio can bring diversification benefits and potentially improve its risk-adjusted returns.

From robotics to clean energy, thematic equity strategies strive to capitalise on sources of long-term secular growth. But the arguments for allocating capital to thematic equities don't end there. Thematic stocks also hold their own from an asset allocation view point, helping diversify a portfolio's investments and potentially improving its risk-adjusted returns.

That’s because, by its very nature, thematic investment favours companies with distinctive characteristics and that are differentiated from those represented in mainstream global indices – be that in terms of size, sector or style.

A hallmark of thematic equities portfolios is that they contain stocks that don’t feature prominently in common stock indices. That is probably not surprising given that thematic funds tend to concentrate investments in niche industries. Less obvious, however, is that this holds true even for broad, multi-themed strategies such as Pictet Asset Management’s Global Megatrend Selection (GMS).

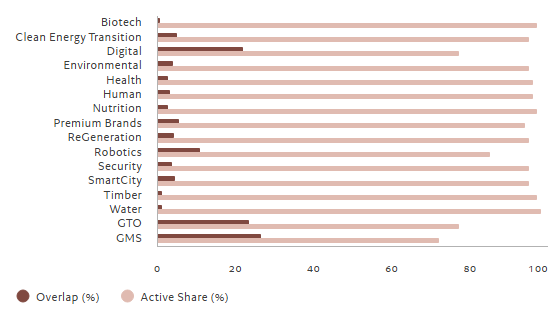

In fact, a third of the stocks in the GMS portfolio are entirely absent from the MSCI All Countries World Index (ACWI); the overlap by weight between the two stands at just 26% (see Fig. 1). In other words, thematic equity portfolios have a significant active allocation relative to the index, known as a high active share.Overlap is calculated as the sum of all overlapping portfolio holdings within the index, adding up the minimum of the two weights.

Fig. 1 - Distinct characteristics

Overlap and active share for selected Pictet Asset Management thematic strategies compared to MSCI ACWI, %

Source: MSCI, Pictet Asset Management. Data as at 30.06.2025.

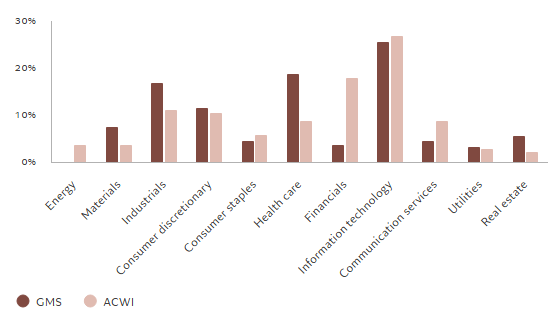

A high active share can sometimes mean that investments are concentrated in just a few sectors, but this is not the case for multi-themed strategies. The sector composition of GMS is broad, but significantly different from that of ACWI (see Fig. 2). Notably, GMS features more industrial and healthcare stocks, while the allocation to financials is much reduced relative to ACWI and energy is entirely absent.

These results do not arise by chance. Our search for high quality businesses with solid growth characteristics tends to eliminate many companies in energy and financials sectors, which have struggled to sustain upward momentum in economic profits over the long term.

Fig. 2 - Sector selection

Sector composition, % share of portfolio/index

Source: MSCI, Pictet Asset Management. Data as at 30.07.2025.

Wilt u het hele artikel lezen, klik dan hier.