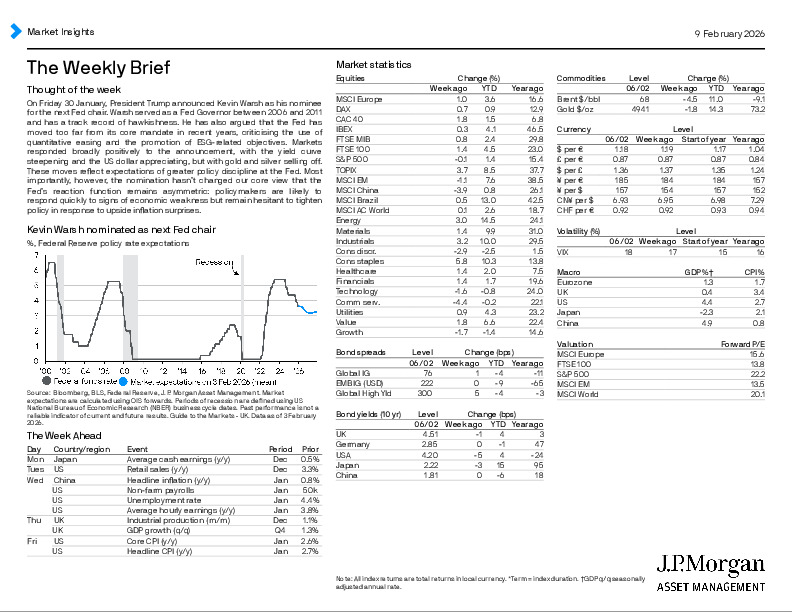

Rather than triggering a regime shift, Kevin Warsh’s nomination as Fed chair sharpened market focus on policy credibility and reaction functions, according to this J.P. Morgan weekly brief.

-

Markets welcomed the signal of greater monetary discipline, with curve steepening, a firmer dollar, and weaker gold reflecting expectations of tighter policy guardrails.

-

Despite Warsh’s hawkish reputation, the Fed’s reaction function remains asymmetric—quick to ease on growth weakness, slow to tighten on inflation surprises.

-

Asset performance shows rising dispersion: Europe and Japan lead equities, while growth stocks and China lag amid policy and valuation headwinds.

How durable is this market optimism if growth momentum fades? The full brief explores the macro signals shaping asset allocation.