Summary

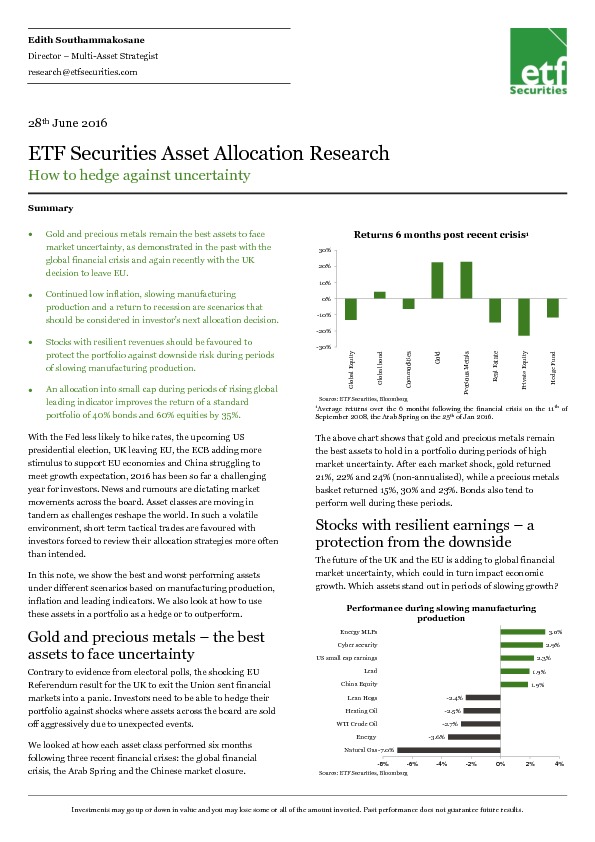

- Gold and precious metals remain the best assets to face market uncertainty, as demonstrated in the past with the global financial crisis and again recently with the UK decision to leave EU.

- Continued low inflation, slowing manufacturing production and a return to recession are scenarios that should be considered in investor’s next allocation decision.

- Stocks with resilient revenues should be favoured to protect the portfolio against downside risk during periods of slowing manufacturing production.

- An allocation into small cap during periods of rising global leading indicator improves the return of a standard portfolio of 40% bonds and 60% equities by 35%.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.