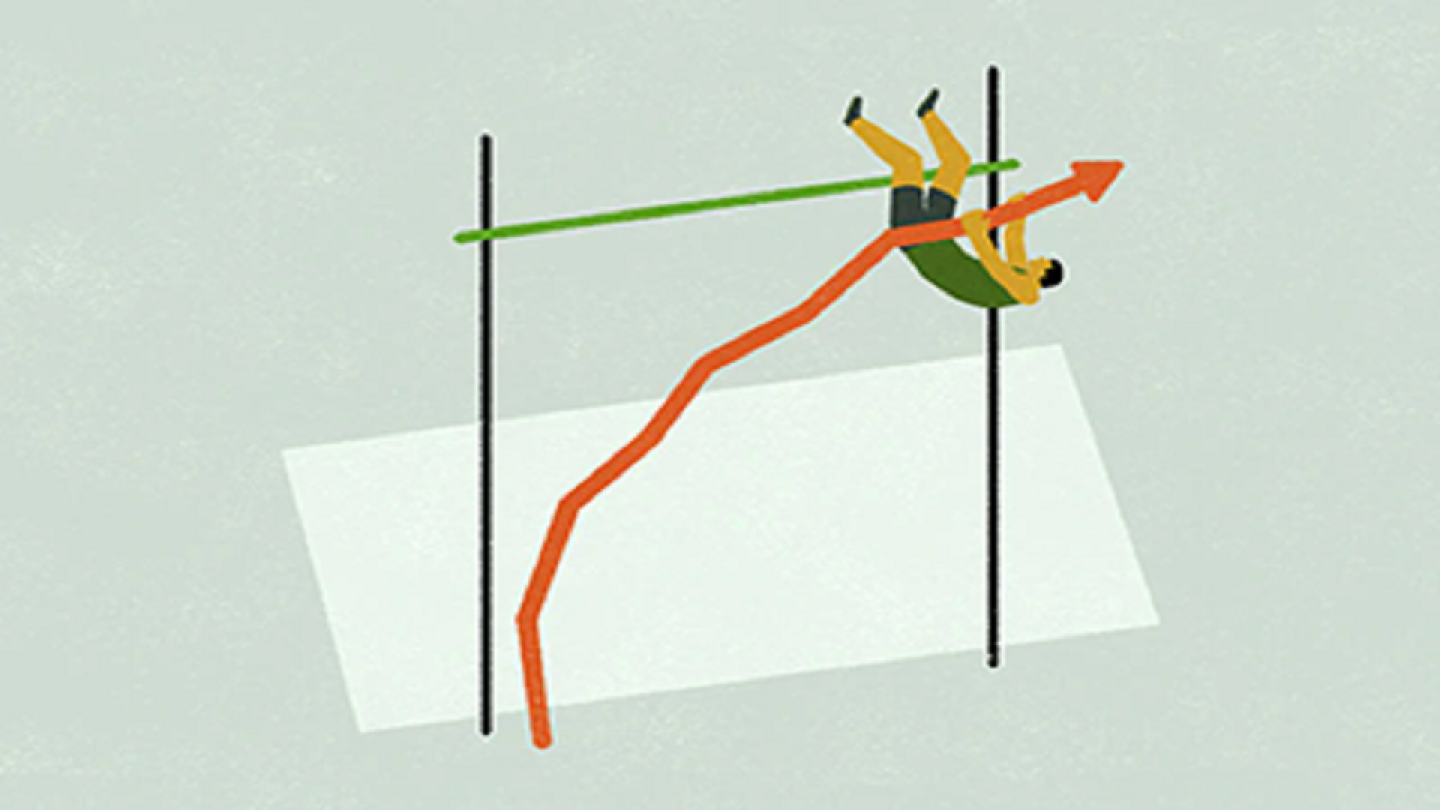

Investors are seeking dynamic, actively managed equity solutions to navigate today’s shifting markets. State Street Investment Management introduces ETF share classes for six SICAV funds, each designed to deliver enhanced, risk-controlled, actively managed equity exposure within a transparent ETF structure.

These new ETF share classes combine the proven track record of active management with the efficiency and transparency of the ETF structure. Each fund leverages State Street’s proprietary alpha generation and portfolio construction processes, targeting robust performance, disciplined risk control, and sustainability integration.

Why choose State Street’s active Systematic Equity strategies?

• Performance: 100% / 100% / 94% of our benchmark-aware strategies have outperformed their respective benchmarks over three-, five- and ten-years.

• Scale: $32B USD Assets Under Management (AUM), spanning global, regional, large and small cap universes strategies.

• Heritage: State Street’s enhanced strategies are one of the longest serving capabilities, dating back to 1993, using over 80 proprietary Alpha signals.