Paul Reuge, European Equities Portfolio Manager

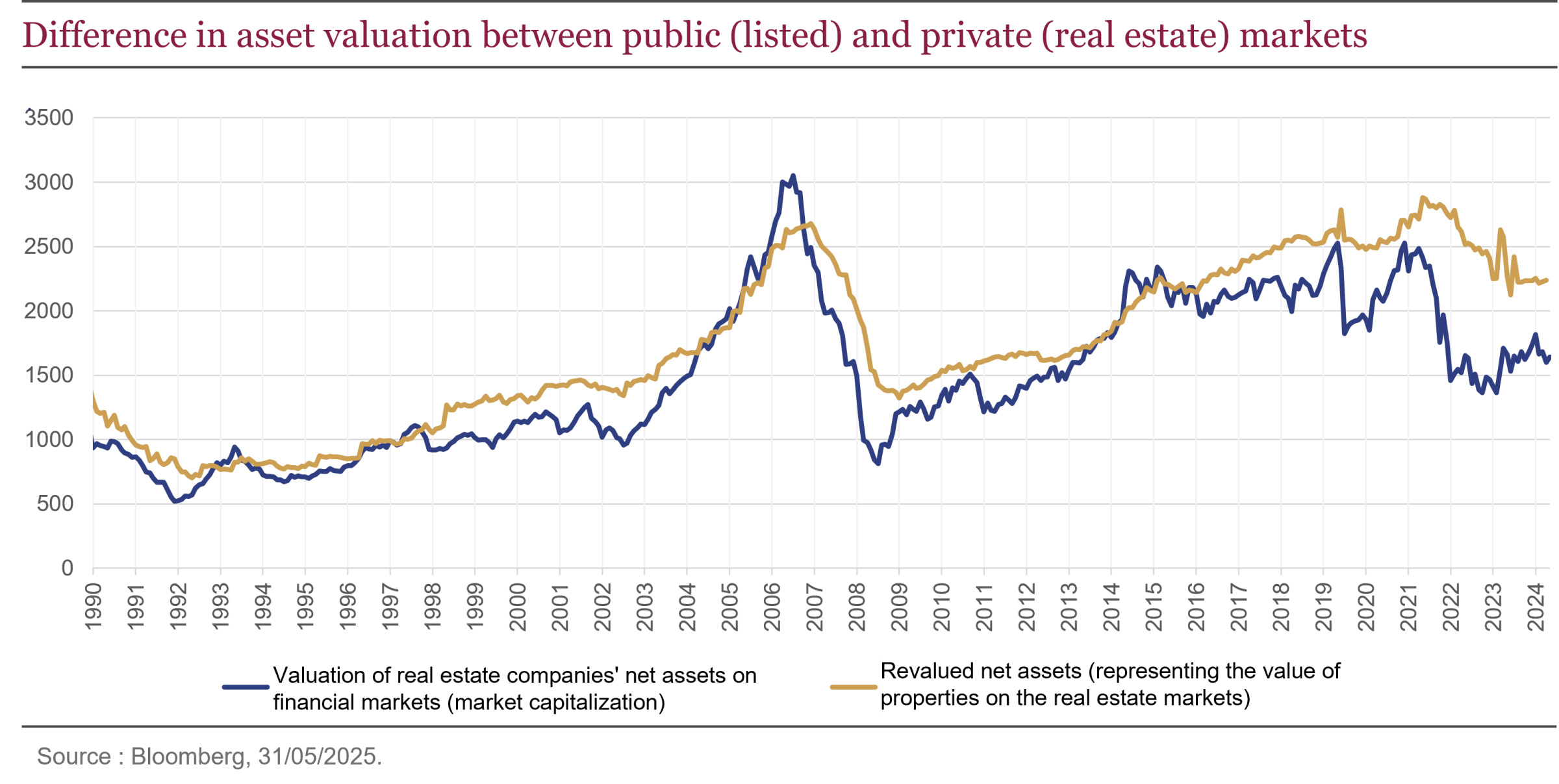

Is the discount to net asset value still a valuation anchor for real estate investment trusts? That is a legitimate question after three consecutive years of sector-wide discounts exceeding 25%—a record not seen since the 1990s (1).

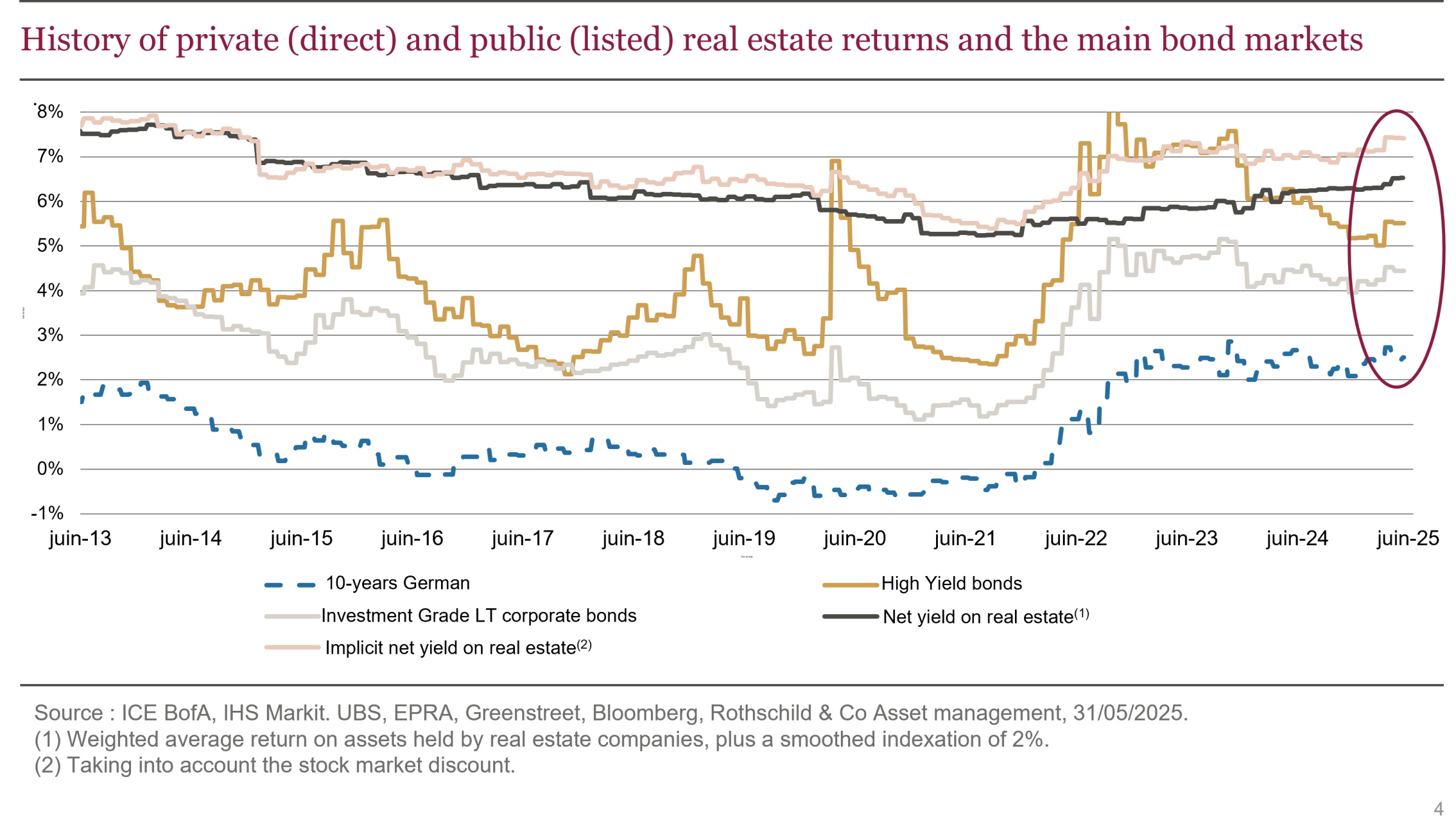

The increase in interest rates has driven investor disaffection, resulting in a downward adjustment in real estate valuations—an impact that varies in magnitude depending on asset type and lease profile. This trend is now coming to an end, unless we anticipate a further significant rise in long-term interest rates (>50 basis points). The price correction has enabled real estate to regain attractive yields, relative to other asset classes. What's more, listed real estate is benefiting from a discounted entry point.

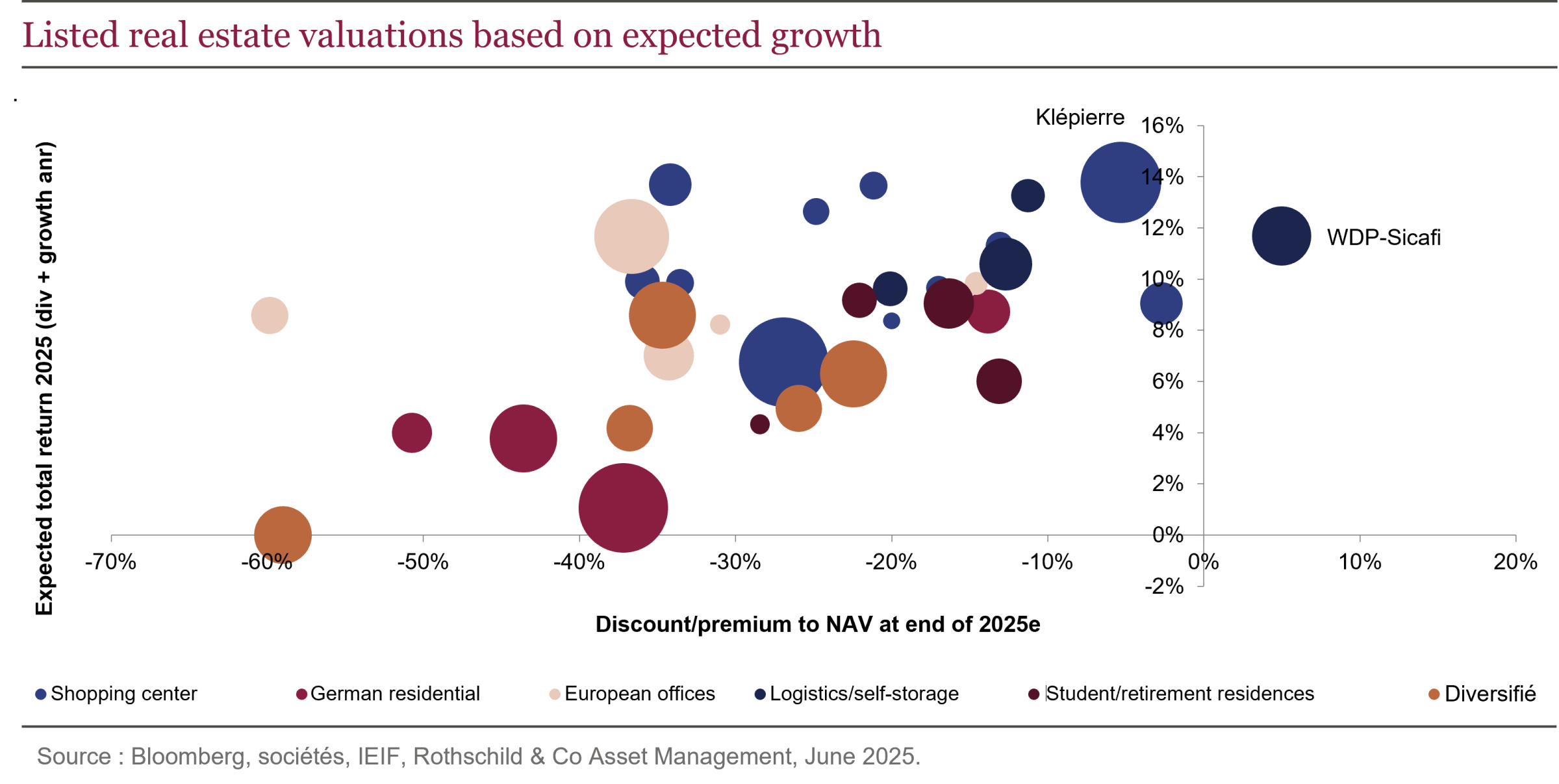

However, investors remain cautious toward listed real estate companies; only those offering growth are attracting capital and are trading at a slight premium or close to NAV parity (2) (Klépierre, WDP). The phase of adjustment to the sector's historical average discount of 10% (3) does not appear to represent an intermediate stage in this cycle.

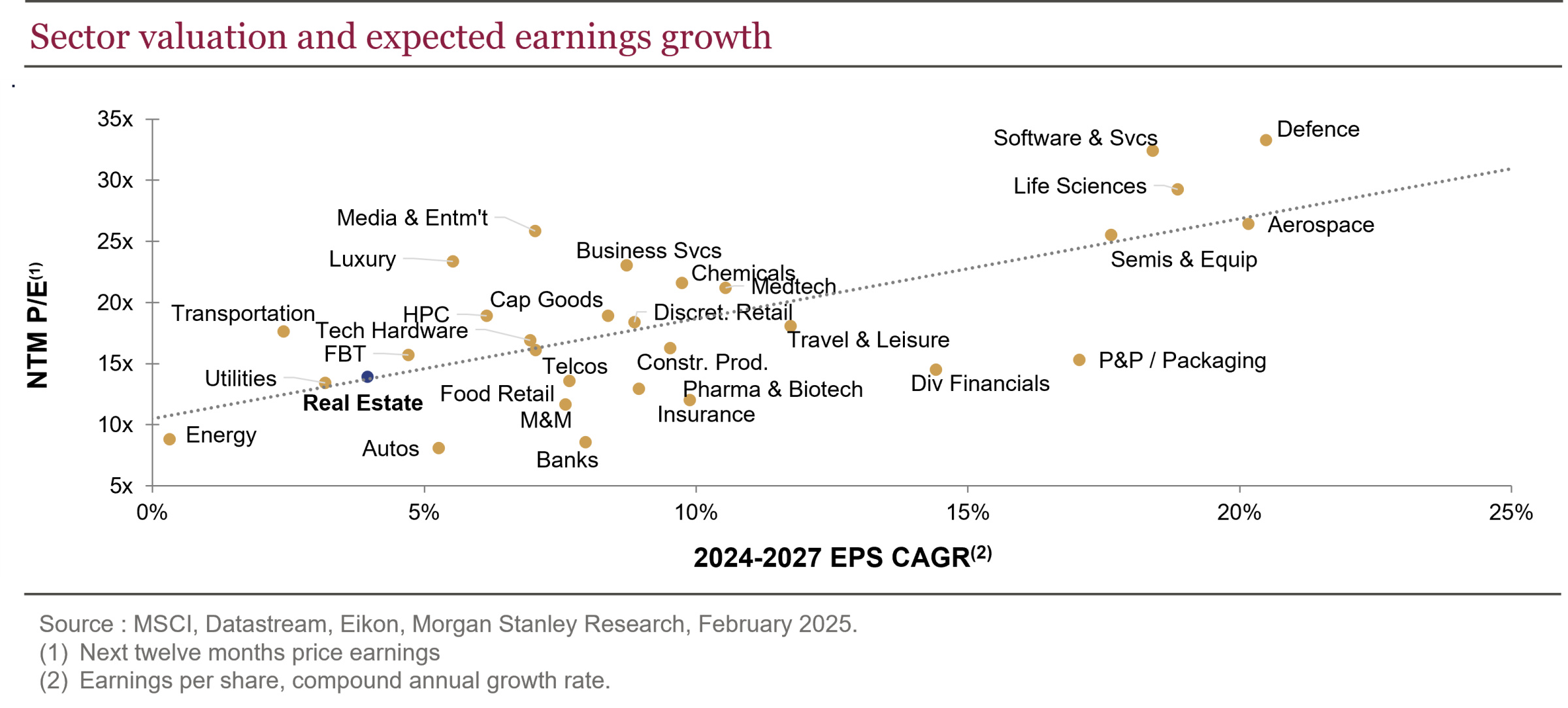

More generally, this observation applies to all sectors. Real estate seems to be correctly valued, purely in terms of relative growth.

However, at this stage, few companies are in a position to seek growth without carrying out a capital increase. Yet, the current level of discount makes this option too dilutive, and issuing new debt would worsen this situation, unless we enter a powerful cycle of falling interest rates (long end of the curve), which seems unlikely given the budgetary trajectories of the main European countries. To get out of this impasse, most real estate companies have no choice but to continue selling off assets. Some, such as Colonial last year, may be able to kill two birds with one stone by financing acquisitions in securities issued at NAV (but this route remains limited), or by exchanging shares to carry out mergers (Aedifica's takeover bid for Cofinimmo last month).

Are we beginning to see the light at the end of the tunnel?

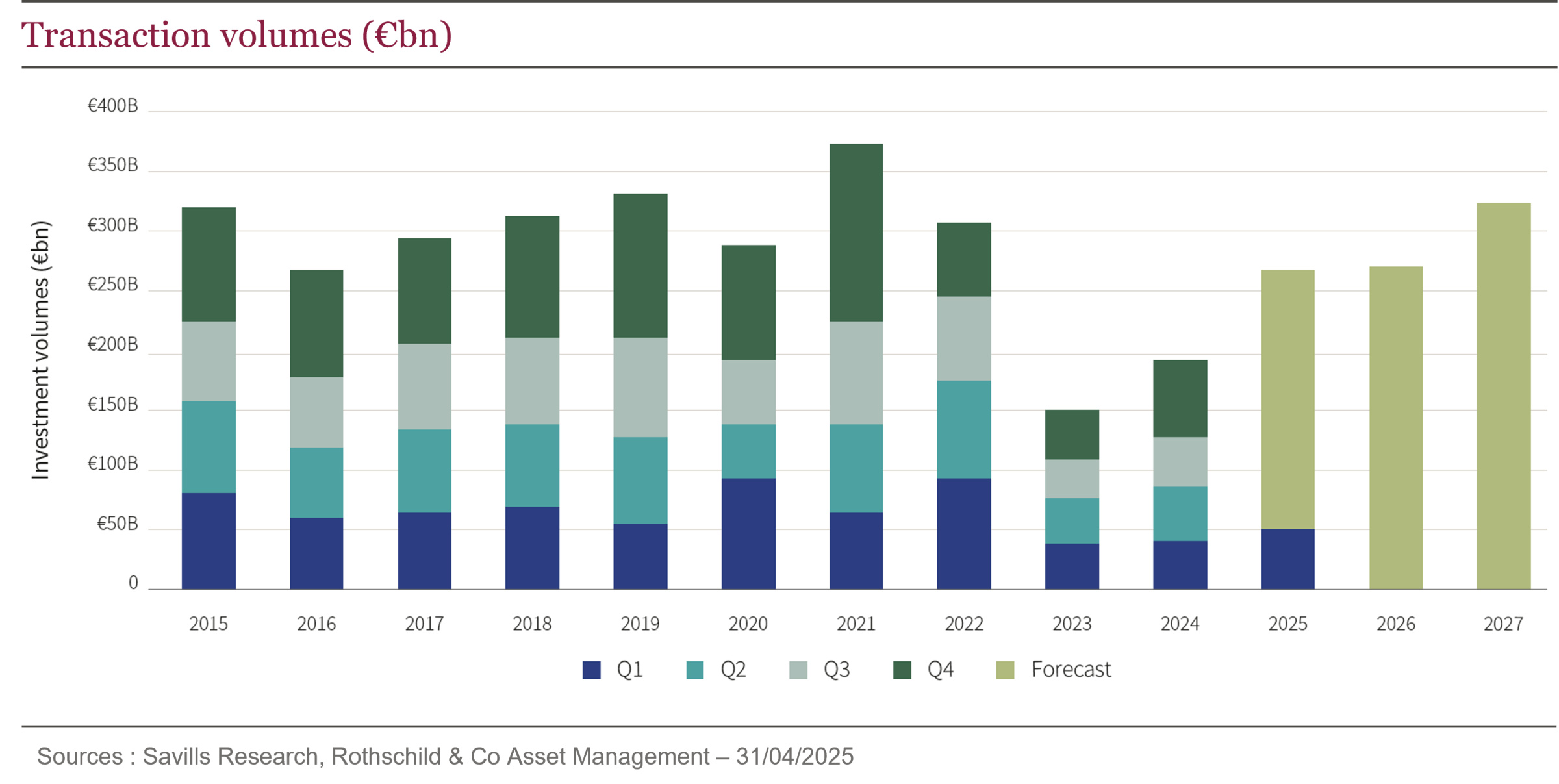

The upturn in real estate investment, albeit gradual at this stage, should change things. On one hand, it confirms that property valuations have reached their bottom — which, in itself, should have already triggered a narrowing of the discount. More importantly, it will help accelerate capital rotation and pave the way for the beginning of a new growth cycle.

By way of illustration, a number of property companies have made acquisitions since the start of the year (WDP, Montea, Wereldhave, etc.), most recently Mercialys, which has just announced a major acquisition of a €146m shopping center near Lyon, representing 5% of its portfolio. The estimated yield is close to 8%, making this a particularly attractive deal (4).

In conclusion, as well as confirming the end of the cycle of asset devaluation, the recovery in the property investment market signals a gradual return to growth in the sector. With no further significant rise in long-term interest rates, this shift should be reflected in the valuation of listed real estate companies.

For more information, visit Rothschild & Co AM website.

[1] Sources: Bloomberg, UBS, EPRA, excluding September 2024 when it was reduced to 20%, it is 30% at 31/05/2025.

[2] Net asset value.

[3] Sources: Société, Rothschild & Co Asset management, 15/06/2025.

[4] Source: Mercialys, June 2025.

Past performance is not a reliable indicator of future performance and is not constant over time. The characteristics/objectives/strategies mentioned above are indicative and subject to change without notice. This analysis is only valid at the time of writing. The geographical and sector allocations and distributions are not fixed and may change over time within the limits of the SICAV fund’s prospectus. The information, comments and analyses in this document are provided for information purposes only and should not be construed as an investment or tax advice, or as an investment recommendation from Rothschild & Co Asset Management.