Emmanuel Petit, General Partner, Head of Fixed Income

As the ECB nears the end of its monetary easing cycle, it is becoming increasingly out of sync with the Fed.

As expected, the ECB cut rates for the fourth time this year at its June 5 meeting. With inflation expected to fall below the 2% target in the Eurozone by the end of 2025, this seems to herald the end of the rate-cutting cycle that began in June 2024. European 2-year yields should therefore stabilize. However, if the Governing Council remains divided on the issue, investors are still expecting a fifth and final cut by the end of the year.

The ECB's wait-and-see stance can be explained by contradictory effects on growth and inflation, driven in one direction by the trade war with the USA, and in the other by the positive effects of the German budget plan, which should be felt from next year onwards. Long-term interest rates, for their part, remain under pressure, as debt financing remains an issue of concern for investors. This movement of mistrust can be observed as soon as concerns emerge about a country's budgetary trajectory.

In this respect, France is currently perceived as the Eurozone's bad boy. While the OAT-Bund spread (1) peaked at the time of last year's general election, it has since gradually narrowed to stabilize at around 70 basis points (2). Investors therefore appear to continue to give some credit to the French government, believing that it has many levers at its disposal to achieve a turnaround in public finances. Nevertheless, France's borrowing rate remains one of the highest among the 20 member countries. More generally, the Eurozone remains mired in a scenario of sluggish growth. Defaults have risen slightly, but remain geographically highly concentrated, and no significant deterioration has yet been reported.

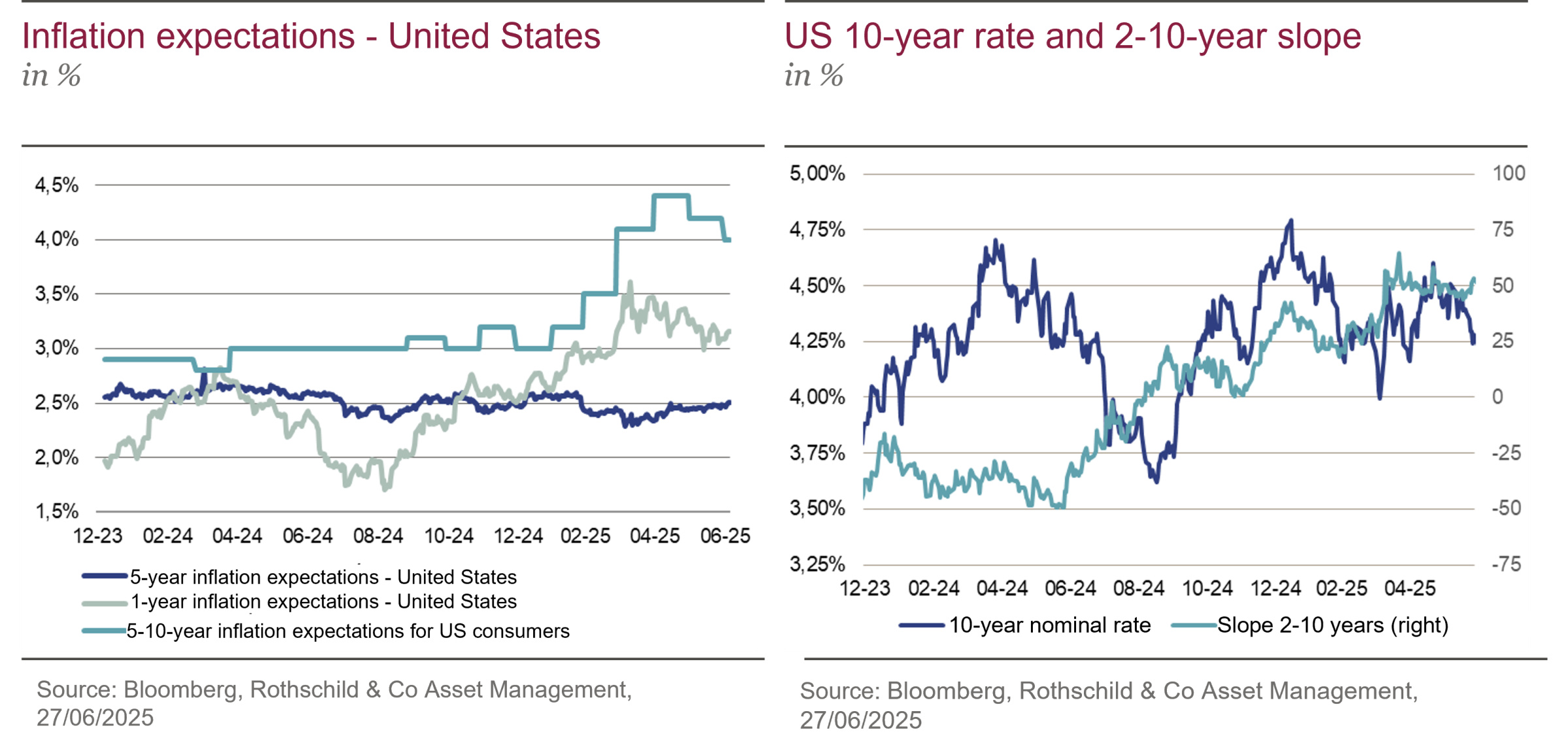

In the United States, the situation is more delicate. Since the beginning of the year, investors have been turning away from US assets. Legitimate questions about the twin deficits3, Donald Trump's procrastination and doubts about the durability of American exceptionalism have led to a wave of mistrust and a drop of more than 10% in the dollar against all currencies (2). The interest-rate differential in favor of US bonds is no longer sufficient to strengthen the currency. Even so, an acceleration in the greenback's depreciation over the coming months seems difficult to envisage, in a context presenting few alternatives to the US currency.

The risk of inflation and questions about the sustainability of the debt also remain high, due to the policies pursued by the current occupant of the White House. In this respect, the “One Big Beautiful Bill” (4) enacted at the beginning of July accentuates fears of a widening deficit, but nevertheless tempers the most pessimistic scenarios. The progress of tariff negotiations remains investors' main concern. The sudden and untimely announcements, as well as the various postponements, only add uncertainty to an already tense geopolitical environment. Against this backdrop, the Fed has maintained the status quo since the beginning of the year.

Indeed, with inflation expected to rise until September due to base effects, uncertainty caused by tariffs and a labor market that is slowing but not cracking, it seems logical that the Fed should remain cautious. Given current key rate levels, the market is aware that the central bank has considerable room for manoeuvre before reaching the neutral rate, which it estimates at between 3% and 3.25%. Five rate cuts are anticipated between now and the end of 2026. This scenario remains plausible if inflation returns to target and the job market holds up. Beyond the economic dimension, other factors such as the appointment of the next Fed Chairman or the mid-term elections could lead to a review of this outlook.

Faced with this situation, credit is currently the least volatile asset class. Its absolute yield and spread levels vis-à-vis government bonds enable it to withstand interest-rate volatility. The current environment is particularly favorable: interest rates are low and the economy is holding up well. Spreads may be tight, but investors are still very interested, as corporate fundamentals are solid and the asset class offers good carry.

In this context, we need to be particularly reactive, and every episode of volatility should be seen as an opportunity to be seized. We also need to be selective, because while there is little sectoral dispersion, within each sector, the most fragile player is quickly punished by the market. We are therefore gradually adjusting our portfolios. We are marginally increasing sensitivity, while remaining underweight in anticipation of a more significant steepening of the curves. We favor top-rated corporate bonds with maturities of 5 to 10 years to benefit from the excess yield they can capture. Financials also remain a favored market segment, given their valuation levels and the fundamentals of the sector's players. Lastly, we continue to hedge our portfolios via CDS (5) to cushion potential spikes in volatility.

For more information, visit Rothschild & Co AM website.

(1) Yield differential between a bond and a loan of equivalent maturity considered ‘risk-free’.

(2) Source: Bloomberg, 30/06/2025.

(3) Budget deficit and current account balance.

(4) US tax law enacted by Donald Trump.

(5) Credit Default Swaps (CDS) are derivatives used to insure against the risk of non-payment of a debt issued by a government or company. This hedge is applied to the party.

Past performance is not a reliable indicator of future performance and is not constant over time. The characteristics/objectives/strategies mentioned above are indicative and subject to change without notice. This analysis is only valid at the time of writing. The geographical and sector allocations and distributions are not fixed and may change over time within the limits of the SICAV fund’s prospectus. The information, comments and analyses in this document are provided for information purposes only and should not be construed as an investment or tax advice, or as an investment recommendation from Rothschild & Co Asset Management.