The July 2025 CIO View Portfolio Perspectives from DWS outlines tactical shifts across equity, fixed income, and FX, reflecting evolving macro risks, valuation gaps, and sector-specific opportunities.

-

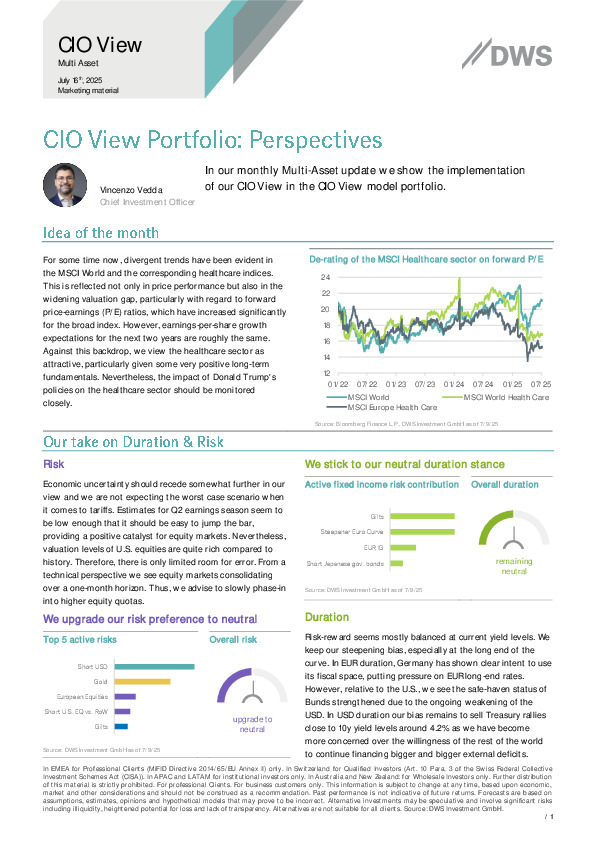

Equity rotation underway: U.S. equities are reduced in favour of European stocks (+1) and global healthcare, which now trades at attractive forward valuations despite stable EPS outlooks.

-

Fixed income positioning steady: Duration stance remains neutral, with a steepening bias at the long end—particularly in EUR rates as fiscal policies evolve.

-

Cautious optimism returns: DWS upgrades overall risk stance to neutral, citing fading macro tail risks and supportive earnings season expectations.

Interested in how DWS expresses these views in a liquid multi-asset portfolio? The full report offers a breakdown of implementation and risk allocation across geographies and asset classes.