GMO’s Asset Allocation team outlines a rare opportunity in value investing, supported by historical valuation metrics and a disciplined approach to relative pricing across U.S. and global equities.

-

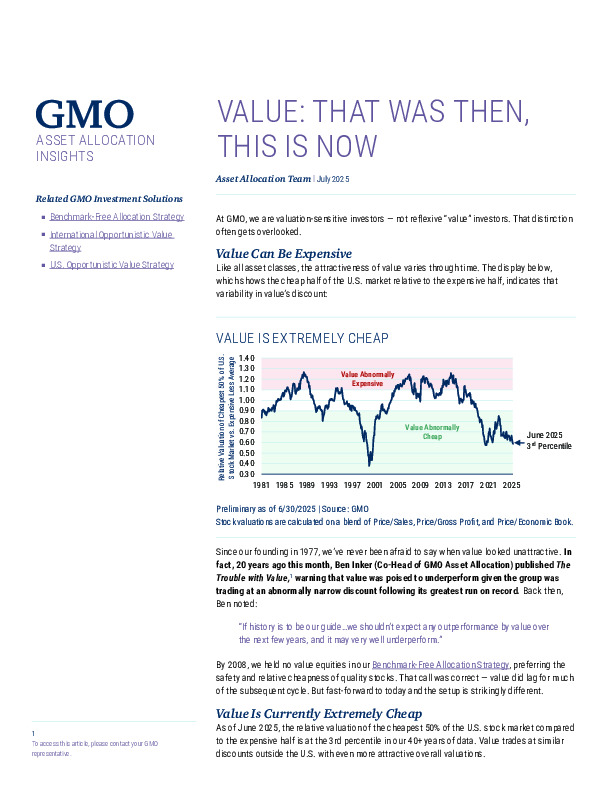

Extreme valuation gap: As of June 2025, U.S. value stocks trade at their 3rd percentile relative to growth—one of the deepest discounts in over four decades.

-

Selective opportunity: GMO emphasizes deep value (cheapest 20%) over broad value, citing stronger fundamentals and wider mispricing.

-

Tactical conviction: Current conditions mirror prior turning points (e.g., 1999, 2020), where valuation-aware positioning paid off.

What role should deep value play in a disciplined portfolio today? The full note explores the case for acting while the window remains open.