This June 2025 Asset Allocation Outlook by Van Lanschot Kempen, led by Joost van Leenders and the Investment Strategy team, analyzes global macro and market trends driving current portfolio positioning.

-

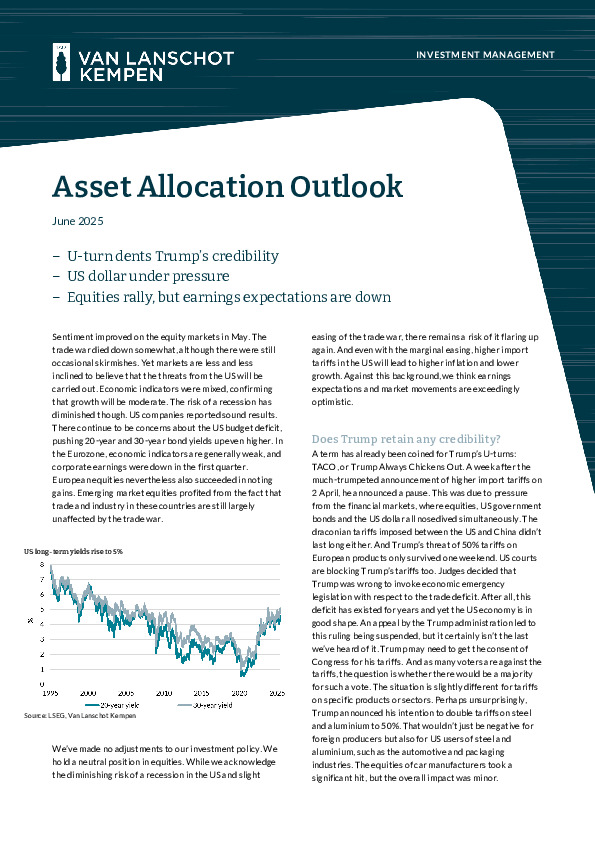

Equities rose globally on easing trade tensions and strong Q1 earnings, but valuations—especially in the US—appear stretched relative to earnings revisions and bond yields.

-

Economic data point to moderate growth in the US and Eurozone, while China weighs on emerging markets; inflation is cooling, yet policy divergence continues.

-

Given persistent geopolitical and valuation risks, the team maintains a neutral stance on equities and prefers government bonds over credits.

Explore the full report for detailed positioning, risk assessments, and regional breakdowns across all major asset classes.