State Street Global Advisors delivers a sharp commentary on the implications of rising U.S. debt levels and the recent Moody’s downgrade, assessing its muted market response and the broader consequences for asset allocation strategies.

-

Moody’s downgraded U.S. debt to Aa1, echoing earlier moves by S&P and Fitch—yet markets showed minimal reaction.

-

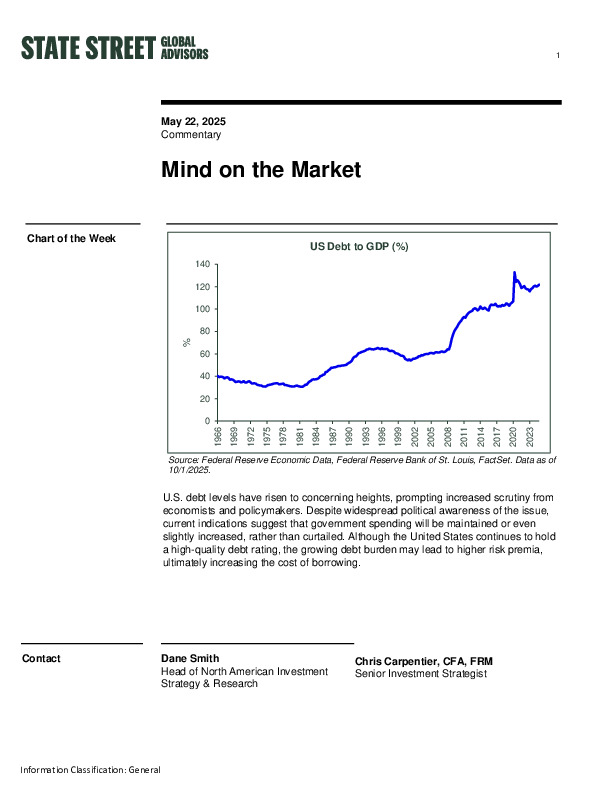

U.S. debt remains near 120% of GDP, with no signs of fiscal tightening despite mounting interest costs.

-

Elevated yields may shift preferences toward bonds and challenge traditional stock-bond correlation assumptions.

Explore how evolving debt dynamics could reshape your investment strategy.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.