In an ever-evolving landscape marked by geopolitical tensions, the fore fronting of climate change, and a global economic reorientation, a discernible megatrend is unfolding. Growth is gradually shifting to developing countries outside of China, a shift intensified by demographic advantages and a changing global economic structure. While geopolitical rifts foster near-shoring, some developing nations face challenges as their once advantageous demographics now pose risks due to an aging population. The transformative impact of climate change and AI-driven automation further complicates the global economic equation.

The global trade cards are being reshuffled

The 90s witnessed the rise of the modern technological revolution, leading to the outsourcing and offshoring of production to countries with cheaper labor and more relaxed environmental standards. Reshuffling supply chains or “China plus one” strategies create opportunities for many other developing countries, especially in Mexico, India and South East Asia, where global corporates have started to invest in alternative supply chains.

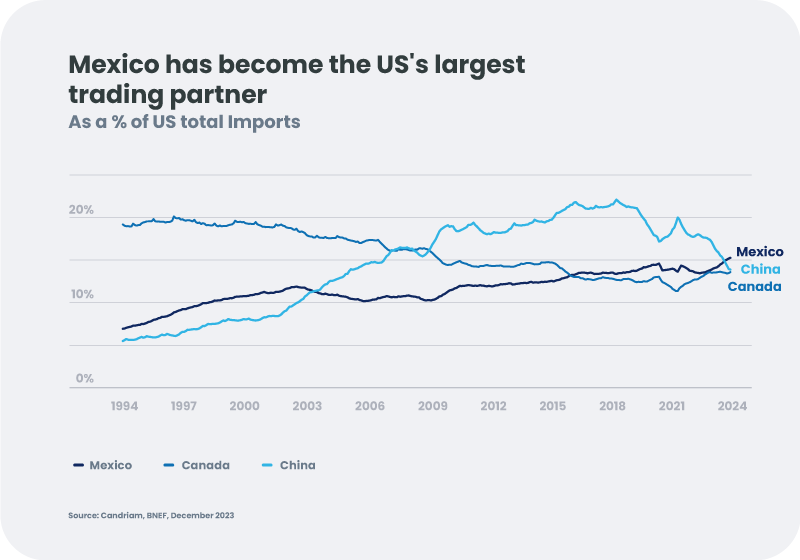

Mexico has emerged as an early winner given its geographic proximity to the US, and has already become the largest trading partner to the US. Back in Asia, supply chain diversification efforts are providing growth tailwinds for manufacturing and export driven companies in India – in sectors like Pharma, Biotech and Electronics manufacturing.

When considering the potential of each country to benefit from the new decarbonized global economy we need to consider population dynamics, and the country’s capacity to take an active part in the transformation and exploit new sources of demand domestically and more locally.

Read more: In the emerging markets galaxy, meet the new rising stars | Candriam (candriamoutlook.com)