Energy shock spurs Europe’s recession

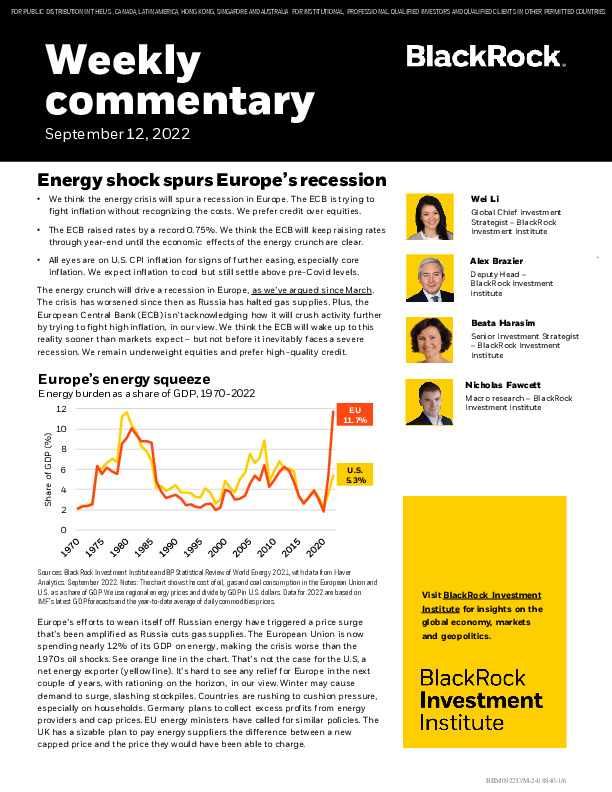

We think the energy crisis will spur a recession in Europe. The ECB is trying to fight inflation without recognizing the costs. We prefer credit over equities. The ECB raised rates by a record 0.75%. We think the ECB will keep raising rates through year-end until the economic effects of the energy crunch are clear. All eyes are on U.S. CPI inflation for signs of further easing, especially core inflation. We expect inflation to cool but still settle above pre-Covid levels.

Om dit artikel te lezen heeft u een abonnement op Investment Officer nodig. Heeft u nog geen abonnement, klik op "Abonneren" voor de verschillende abonnementsregelingen.