Green Capex is emerging as a powerful secular growth theme for investors as greater capital is required to meet net zero, clean water and infrastructure mandates. Within the theme, a mosaic of key technologies and impacted sectors exist, including ‘Greenablers’ - companies operating in what we describe as building block sectors where increased reinvestment will be needed. Below we discuss the scope of Green Capex, funding requirements and where we see long-term investment opportunities.

The amount of capital committed net zero targets is accelerating rapidly and is indicative of where we're going at a country, corporate and consumer level. How does this impact capital? Those capital allocators being asked to undertake massive infrastructure projects with long duration are going to need to be incentivized with attractive and more importantly, durable returns. Many corporates and sectors are still very early in starting their net zero journeys and if they are successful over time, which we expect many will be, the alpha opportunities for investors look sizable. Ultimately, we expect Green Capex to be the dominant driver of global infrastructure over the next decade and a stock-impacting investment theme for both sustainability fund managers and generalist investors.

We believe the building blocks needed to execute on UN Sustainable Development Goals (SDGs) alone will require investment with long lead times (2-12 years) to avoid bottlenecks and delays. While there has been much focus on Green Capex for final products such as residential solar expansion, offshore wind farms, and electric vehicles — there has only recently begun to be a focus on the building blocks needed to ensure execution to achieve key SDGs. We view the products and companies operating in these areas as ‘Greenablers’ (Green Enablers). Examples include semiconductors (which improve efficiencies of end-products), copper (the commodity has a direct role in the production of batteries and renewables) electricity transmission lines (critical for successful renewables expansion). We also believe cybersecurity will play a more important role in automation and related energy efficiency gains.

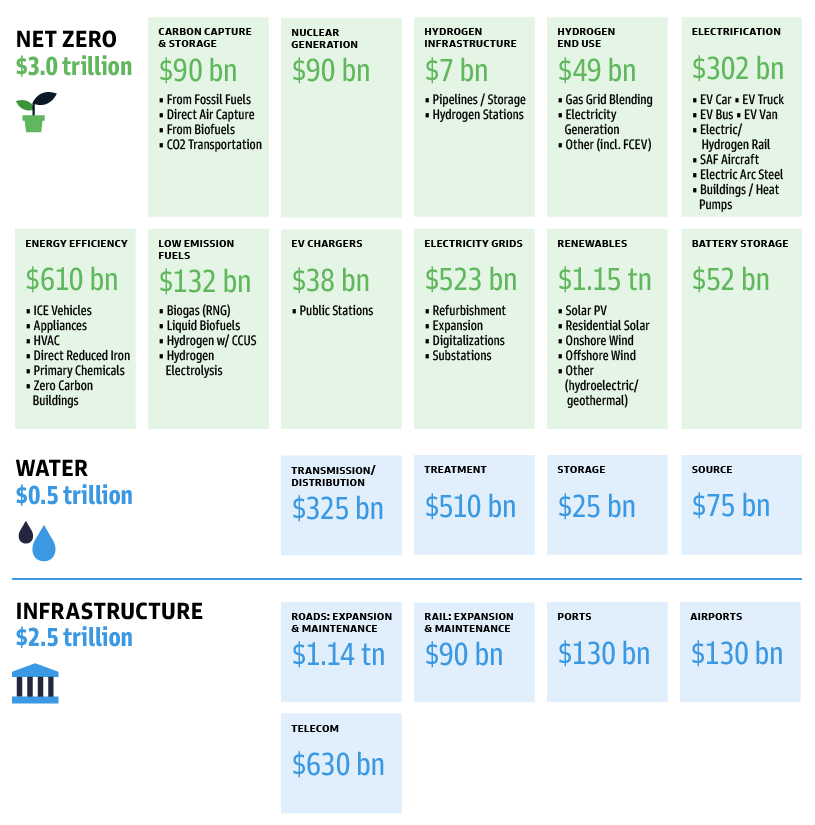

EXHIBIT 1: GREEN CAPEX COVERS A VARIETY OF KEY TECHNOLOGIES AND SECTORS

Source: IEA, McKinsey, OECD, Company data, Goldman Sachs Investment Research

The need for Green Capex is immense – approximately $6 trillion annually this decade, up from $3.2 trillion per year in 2016-20 according to Goldman Sachs Research[i]. As more countries pledge to achieve net zero, largely by 2040-2050, we expect governments will provide infrastructure, water and clean energy stimulus via tax breaks, grants and direct investments. Legislation will also be major factor and increase the amount of public funding for capital investment. On the corporate side, Green Capex spending today does not appear to be sufficient, but we believe there is ample capacity for additional expenditure across most sectors, supported by free cash flow and balance sheets. Reinvestment of cash flow into capex and research & development has declined over the last decade and is expected to be circa 50% in 2022 versus the 60%-70% levels seen over much of the prior decade, while balance sheets have strengthened. As a result, publicly traded companies are investing $1 trillion per year less than they have historically, which we regard as spare capacity that could be deployed into Green Capex. We also expect greater investor credit for companies with attractive corporate returns investing incremental Green Capex. More recently, we have seen a surge in green private equity capital raises, and future growth is likely to be strong.

The Potential for Long-Term Earnings Growth

The stock market has rewarded companies with Green Capex and can continue to do so, in our view. We have witnessed equity outperformance from Green Capex-exposed companies reinvesting a rising percent of cash flow in capex and research & development, and the ‘Greenablers’ where increased reinvestment will be needed more urgently due to project lead times. It is important to remember that companies investing in Green Capex reduce not only their emissions, but the emissions of their customers. As such, we expect firms making incremental Green Capex investments to see durable demand for their products and long-term earnings growth. In certain sectors, such as utilities, we already see direct relationships between carbon reduction targets and earnings growth. Going forward, we expect investors to look closely at whether companies making major increases in reinvestment rates are maintaining strong corporate returns. We believe there is significant room for investor capital to support those who are. In addition, investors may look for greater disclosure (alongside regulations such as the EU’s Taxonomy for Sustainable Activities) for managements to classify and disclose capex for green or broader sustainable use cases.

Importantly, the path to net zero will require breakthroughs across multiple green technologies, as decarbonizing harder-to-abate emissions (eg, emissions in industrial processes, long-haul transport) require solutions that are still relatively nascent and expensive to implement. As has been seen across multiple sectors from semiconductors to shale to solar, greater investment and innovation can lead to lower costs. As an example, the levelized cost of energy for renewable power has decreased by more than 70% since 2008, and the overall cost curve of carbon abatement has also decreased due to innovation and scale. The urgency to foster cost deflation across various decarbonization technologies and build new solutions is why we believe companies exposed to our Green Capex themes, both public and private, will play an increasing role in a low carbon economy in the long-term.